The Department for Industry, Innovation and Science has said that homeowners and businesses whose properties and cars had been destroyed or damaged by floodwaters were to receive tax relief.

The Department for Industry, Innovation and Science has said that homeowners and businesses whose properties and cars had been destroyed or damaged by floodwaters were to receive tax relief.

The Department said those whose properties had been destroyed or substantially damaged by floodwaters would be eligible for Stamp Duty relief of up to $48,830 on purchasing a new home.

It said the Government would also waive 2022-23 Land Tax liabilities for business properties and long-term residential rentals that were substantially damaged or destroyed.

“This includes Holiday rental properties will also be eligible for Land Tax relief where an owner can demonstrate a loss of bookings/income,” the Department said

“However, full-time private holiday homes will not be eligible, “it said.

Additionally, the SA Government is also to provide Stamp Duty relief on vehicles purchased to replace another destroyed or lost in the floods.

“The relief will be worth up to $2,816 on the purchase of a non-commercial vehicle and $2,127 for a commercial vehicle,” the Department said.

“Vehicle owners will also be entitled to relief equivalent to the Emergency Services Levy paid on the active registration period of their lost or destroyed vehicle,” it said.

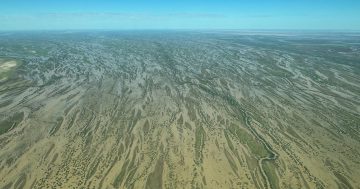

The SA State Emergency Service estimated almost 1,200 kilometres of road and nearly 3,300 properties, including more than 360 principal places of residence, may have been impacted by flood waters.

It said the Government was working collaboratively with many stakeholder groups, including SA Power Networks, to map out the next steps once water levels recede and access to inundated properties are safe.

In the meantime, the impacted households can register for a free waste clean-up assessment by calling the Information Line on 1800 302 787.

Further information about the tax relief can be accessed at this PS News link.