The next phase of stamp duty reductions has come into effect with the tax fully abolished for off-the-plan apartment and townhouse purchases up to $500,000.

The next phase of stamp duty reductions has come into effect with the tax fully abolished for off-the-plan apartment and townhouse purchases up to $500,000.

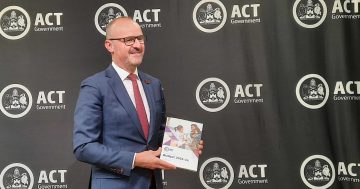

Treasurer, Andrew Barr said the Territory had been leading the country in removing inefficient taxes and since 2012 had been reducing stamp duty.

“Our priority through the next phase of stamp duty reductions is to focus on the most affordable end of the housing market,” Mr Barr said.

“With these changes, anyone purchasing an off-the-plan apartment or townhouse valued at $500,000 will save $10,360,” he said.

“This is a further step in our tax reform program and one that encourages an increased supply of housing below the $500,000 threshold.”

Mr Barr said that if the tax reform hadn’t started in 2012, and if the ACT had continued to raise revenue in the same inefficient way, buyers would be paying $20,500 in stamp duty for the same property that could now be purchased with zero stamp duty.

The Treasurer said stamp duty had also been cut across a range of other property purchases.

“Duty on any owner-occupier purchase between $200,000 to $1,455,000 will be $1,040 lower in 2021-22 than in 2020-21,” he said.

Further information on the stamp duty changes can be accessed the ACT Revenue Office’s website at this PS News link.