Domunique Lashay* says the pandemic was a rude awakening for people who were delaying building their financial security and explains five positive money habits she only adapted because of quarantine.

I started getting serious about my financial situation in the summer of 2019.

I started getting serious about my financial situation in the summer of 2019.

I read everything I could get my hands on about financial planning, I worked on unravelling my many negative beliefs about money, and I set up all the right bank accounts.

But even though I was taking steps in the right direction, I struggled to fully adopt good money habits and practice them consistently in my everyday life.

I lived under the dangerous assumption that because I was still young I was allowed to be irresponsible with my money.

I told myself it was okay to slack off on my savings goals or disregard my spending budgets in favour of this idea of being young and carefree.

I thought I had all the time in the world to figure it out and that one day I would just wake up and be ready to start taking my money seriously.

When the COVID-19 global pandemic hit at the beginning of March 2020, it was a rude awakening.

I realised how wrong I had been, thinking I had so much time to improve my financial situation.

I quickly learned the importance of making responsible financial decisions all the time and every day because you can never know when there might be an emergency.

I am incredibly fortunate and privileged to still be working full-time during the pandemic.

I feel immensely grateful that I have not been laid off or let go, although I did receive a significant pay cut.

In order to manage this and other COVID related life changes due to the virus, I have had to get honest with myself about my financial habits and make some serious adjustments for the better.

Here are five good money habits I only adopted because of quarantine.

- I started building an emergency fund.

When I first began taking steps toward improving my financial situation, one of the first lessons I learned was the importance of setting money aside to use in case of emergencies.

So, I set up high yield savings account with the intention of building an emergency fund.

Each month I would aim to put $500 into the account until I had three – four months of expenses saved.

But when it came time to start actually putting money into the account, I always seemed to find an excuse.

“I need new seasonal clothes”, “How can I say no to dinner with my friends,” “I’ll go to this gym all the time”.

With every excuse, I promised myself that I would make up for the missed amount saved by putting more money in the following week.

In reality, this never happened. I just kept falling further and further behind on my savings goals.

So because of these poor choices and habits, I found myself at the beginning of COVID-19 part of the 36 per cent of Canadians who did not have an Emergency Fund.

During quarantine, I have stopped treating saving like an option and started treating it like a priority.

I started by setting up biweekly automatic payments to my savings account in order to not give myself the opportunity to be irresponsible.

I have since managed to save three months of expenses in my high yield savings account.

- I started looking for other streams of income.

When my boss first phoned me to let me know my salary would be cut due to financial struggles throughout the company, I realised the importance of not keeping all your eggs in one basket when it comes to income.

It may seem naive, but I never really thought about how easy it is for your income to change or be taken away at a moment’s notice and how useful it can be to have something else to fall back on.

I always thought that working as a freelance writer would be fun, but I never seriously pursued it.

Since quarantine, I decided to give it a try and I have since managed to secure multiple writing gigs for different platforms, publications, and small businesses.

Not only has writing helped me feel more financially secure, build my emergency fund, and pay down by dept it has proven to be a much-needed stress reliever and creative outlet for me during these times and greatly improved my mental health.

- I cut unnecessary spending from my life.

I never realised how much I spent unnecessarily until I quarantined.

Expensive lattes, impulse trips to the mall, ordering food when I had groceries in the fridge, and unused memberships were all a part of my daily and weekly spending habits.

With everything closed, I realised there were multiple simple adjustments I could make in my life that would help me save hundreds every month.

I started brewing my coffee at home, taking lists to the grocery store and making all my meals at home, and going for socially distant walks or park visits with my friends instead of going to restaurants.

Although I was technically forced to make these spending changes because of the virus and social distancing measure, I am genuinely enjoying many of them and wondering why I hadn’t made these changes before.

Once restrictions are lifted things start returning to (almost) normal I will definitely continue with most, if not all of them.

Collective these changes have allowed me to save anywhere from $600 – $800 per month.

- I reduced my credit card limit.

A bad financial habit I’ve always struggled with is viewing credit cards as an extension of my income.

In fact, like 40 per cent of Millenials, my biggest source of personal debt is credit cards as opposed to student loans.

In the past, I used credit cards for any large purchases I couldn’t necessarily afford and to fund an overall lifestyle beyond my means.

Because I was able to cut down on unnecessary spending during quarantine, I have been able to pay down half of my total debt.

To deter myself from using credit cards, I reduce my credit card limit periodically as I make debt repayments so that I’m not able to spend more.

Although I may be missing out on an opportunity to improve my credit score by not keeping a wide gap between my total credit available and amount owed (a credit scoring factor called credit utilization), this strategy of reducing my limit has ultimately helped me get — and stay — out of debt.

- I’m building my financial literacy in my spare time.

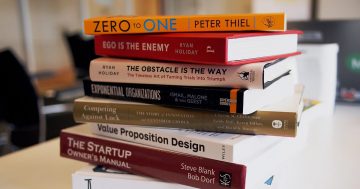

I have been using the extra time I have available due to quarantining to learn more about finances and good financial planning.

I intentionally set a few hours aside every week to read, listen, and watch a wide array of content about money in order to improve my overall financial literacy.

A few favourites are Making it Work by the Financial Diet and So Money with Farnoush Torabi.

Each week I also try to implement one new positive financial change in my life.

I have tried many different habits such as tracking all of my expenses, challenging myself not to order food for an entire week, and checking my credit score for the first time.

Taking my financial learning and putting it into practice is an important aspect of building financial literacy for me and was not something I ever did before the quarantine.

The biggest financial lesson that I have learned due to COVID – 19 and quarantining is that it doesn’t matter who you are or how immune you think you might be, an emergency can strike at any time and you have to be prepared.

The importance of financial planning cannot be overstated and thinking you have time to get your finances in order does not delay the inevitable but instead worsen your situation when the inevitable happens.

Although it took a global pandemic for me to learn this seemingly easy lesson, my financial life has been forever changed for the better.

* Domunique Lashay is a full-time communications manager who is interested in finance, health and wellness, pop-culture, and community service. She can be contacted on Instagram @domuniquelashay.

This article first appeared at thefinancialdiet.com