Prosper Australia has suggested that $27 billion in revenue could be raised if the states adopted the ACT’s approach to land tax. Photo: City Renewal Authority / Facebook.

An independent policy institute has called on the Commonwealth to change the “tax mix” and consider incentivising states to adopt a land tax approach similar to the ACT’s.

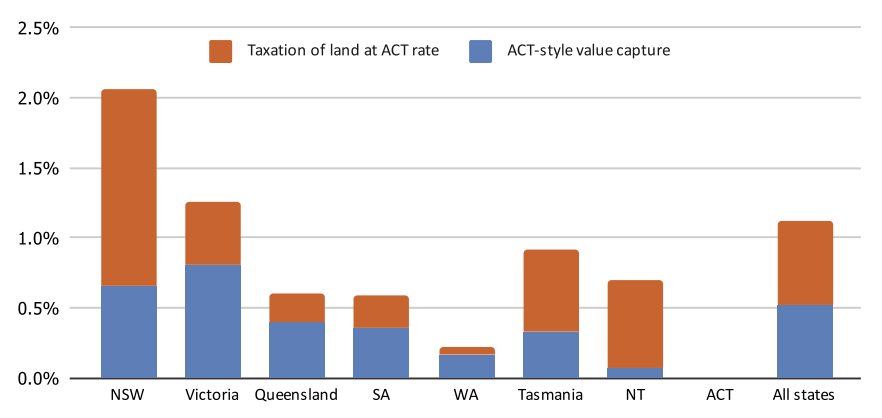

Prosper Australia’s report argues that levelling state taxes on land up to the Territory’s benchmark could raise as much as $27 billion more in revenue each year without reducing investment or growth.

It comes off the back of changes to the Stage 3 tax cuts, which Prosper Australia research and policy director Dr Tim Helm said wasn’t “proper” tax reform.

“The Stage 3 tax cuts debate was all about fairness and who wins and loses from different income tax proposals,” he said.

“[But] proper tax reform is about replacing bad taxes with good ones.”

The pitch is based around shifting taxes from income and onto land to rethink the ‘tax mix’ and increase workforce participation, economic activity and wellbeing.

The report stated low and middle-income earners on welfare payments, combined with income tax, face effective marginal tax rates (EMTRs) of up to 75-80 per cent on extra income.

Many welfare payments – such as the age pension, parenting payment, JobSeeker, Youth Allowance, disability support pension and carer payments – are on part-payments due to means testing, which reduces payments the more money someone earns.

Prosper Australia argued high EMTRs discouraged people from taking on work or increasing their hours.

“Withdrawing [or reducing] welfare payments as incomes rise is economically identical to taxing income … High EMTRs discourage people from taking on work or increasing hours,” the report noted.

“This divorces pay from effort, discourages work, and increases labour costs, reducing GDP. High EMTRs can also create ‘poverty traps’ at low incomes.”

It pointed specifically to childcare costs on top of income tax and welfare withdrawal as producing “disincentives twice as large” as those imposed by the top income tax rate.

“Improving work incentives by lowering welfare taper rates necessarily requires either higher spending as eligibility is expanded to higher incomes, or lower top payment rates if the cost is to be held constant,” the report noted.

“Flattening any part of a rate scale either reduces revenue or requires higher rates elsewhere. It is an inherent problem with a system in which we fund adequate incomes for all by taxing the incomes of people who work and earn more.

“To escape this, we need revenue from elsewhere – ie, from changing the tax mix.”

Prosper Australia argued the ACT was the benchmark when looking at using land tax.

The ACT prices rezoning via its Lease Variation Charge (LVC), which captures 75 per cent of the windfall gains landowners would otherwise pocket when receiving permission to redevelop at a higher density. The Territory also captures 100 per cent of the gains from rezoning rural land for greenfield development.

The Territory also raises more revenue from regular land taxes than other states and territories.

Dr Helm said the potential $27 billion that other jurisdictions could raise by adopting the ACT’s approach could help pay for welfare system reform and reduce work disincentives created by means-testing.

“Our research found that if other states taxed land like the ACT, we’d have enough revenue to cut welfare taper rates in half, giving one million people an effective tax cut of 20-30 cents in the dollar, and putting cash in the pocket of two million more,” he said.

Potential additional revenue as a percentage of GSP from ACT-style taxation of land. Photo: Prosper Australia.

The report noted this could double the net-of-tax return for most welfare recipients, as they could work more hours without being penalised.

It argued low-to-middle income workers with an income range up to $70,000 could have their wages boosted by $4000 to $7000 per annum.

Dr Helm said the Commonwealth could incentivise states to take up the tax reform.

“Adjusting Commonwealth-state grants and providing incentives for states to tax land and rezoning windfalls would be an attractive way for the Commonwealth to drive tax reform where it’s most valuable, which is how well states tax our most efficient base,” he said.

The report concluded: “Even modest changes to land taxation could pay for substantial reform.”

Original Article published by Claire Fenwicke on Riotact.