Sarah Li Cain* shares the four best money lessons she learned from her accountant mother.

Photo: Chris Pastrick

Growing up, I would hear stories about my mum’s job as an accountant for a commercial real estate company around the dinner table.

We would hear terms thrown around like “debit”, “credit” and different ways to incorporate macros in spreadsheets.

Then she started doing bookkeeping for small businesses on the side.

Getting an inside look at how she managed their finances was an eye-opening experience.

When my father started his own side business and I got to help out with the books, I really learnt from my mum about what it means to manage your finances well.

Here are four of the lessons that have stuck with me for years:

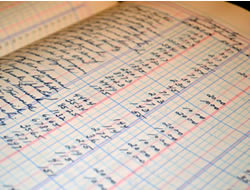

- Tracking numbers matters

You may have heard of the advice to track your numbers, but it really is that important.

You need to see how much you’re earning and what you’re spending before making effective changes to your financial life — be it personal or in your business.

Tracking your finances is much easier thanks to technology.

Back when I first started helping my mum with bookkeeping, we had to keep track of paper invoices and input everything manually (you can take a guess at how old I am).

Now, there are apps and bookkeeping services that can automatically enter in numbers for you.

Once you have the raw data in front of you, it becomes easier to see how you are faring on your financial goals, or to set a savings goal.

For example, my mum would look at profit/loss statements to make sure the businesses were earning money.

It could even help see where you’re overspending and change your ways.

- No number is too small

You know that phrase “small leaks sink great ships”?

It’s absolutely true, especially when it comes to your finances.

It’s not about cutting back on those lattes.

Rather, it’s other expenses you may have overlooked, like recurring memberships you don’t use, or not bothering to check for lower prices elsewhere on your car insurance each year.

My mum would scrutinise my dad’s business expenses every quarter to see what he was spending on and whether there was a similar service for less.

If there was something he never used — like a bunch of magazine subscriptions to industry-specific magazines he never read — she promptly cancelled them.

That alone saved my father hundreds of dollars a year.

- Read the fine print

I get it: Jargon in contracts can be super confusing and intimidating, to say the least.

But if you don’t understand what it is you’re signing, you could be in for a rude awakening.

One of my mum’s clients went on an overseas trip and was shocked at how much the entire trip cost.

As my mum looked into it, she discovered that her client was using a credit card that had a foreign transaction fee attached to it — she was essentially paying an extra 3 per cent for her purchases.

Now, each time I sign a contract or consider opening a new financial product, I always look at the fine print to ensure I’m not going to get caught with fees.

Or at the very least, understand what it is I’m signing up for before putting my name on the dotted line.

- Work with skilled professionals

Not to brag, but my mum was pretty awesome at her job — there’s a reason she was promoted every few years and was booked out on bookkeeping clients.

It’s probably because she worked without much hand-holding and saved her clients and the company she worked for money by doing all of the above-mentioned things.

I’ve learnt that even though it can cost more to work with someone who is good at what they do, it’s absolutely worth it.

I once hired a few contractors to help with my freelance business and I saved so much time and stress working with one that cost a bit more but had rave reviews from other business owners.

This philosophy applies to products, too.

My mum bought office items that were better quality — she still has her office chair 20 years later.

I remembered that office chair when it came time to purchase mine for my home office.

Spending a bit more for a quality ergonomic chair was a great choice because it encourages me not to slouch and I can pretty much guarantee the chair will last me a long time.

Managing your finances well doesn’t have to be hard.

It does take discipline and a willingness to work in your best interest.

Or in my mum’s case, her client’s best interest.

Either way, I’m grateful to have learned skills from my mum that I can use for a lifetime.

* Sarah Li Cain is a finance, real estate and travel writer and host of Beyond The Dollar. She tweets at @sarahlicain and her website is sarahlicainwrites.com.

This article first appeared at www.businessinsider.com.au.