Anthony Caruana* takes a look at the price of apartments and houses around Australia and what mortgage holders can expect to pay to own one.

Although housing prices, according to some analysts, are cooling off, it’s a fair bet that many of us are putting aside a significant portion of our salary on mortgage payments.

Although housing prices, according to some analysts, are cooling off, it’s a fair bet that many of us are putting aside a significant portion of our salary on mortgage payments.

We’ve crunched some numbers to determine where you should live if you want to have as much income left as possible once the bank takes their slice.

According to the most recent housing data from the Australian Bureau of Statistics (ABS), housing prices in every major capital, other than Hobart and Canberra, have seen falls in residential housing values.

Sydney’s market has cooled by 1.2% while Melbourne’s has lost 0.9%.

So, when we think about what we’re paying, it’s probably against the backdrop of the asset you’re funding depurating in value for the first time in a while.

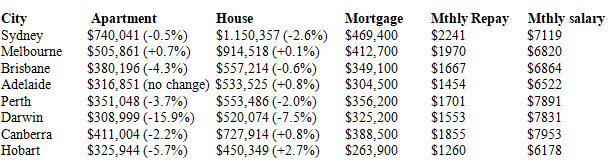

According to the Domain House Price Report, and the ABS’s mortgage data, the median house and apartment prices and mortgages in Australia and average mortgages and repayments are:

I’ve based the repayments on a nominal interest rate of 4% over 30 years for a property you’ll live in. I used Westpac’s repayment calculator.

The one thing that doesn’t easily appear in the averages is that many people will be borrowing at levels exceeding the medians by some margin.

Assuming you have a 20% deposit on a property and you buy at the median prices, you’ll note that in most cases the average mortgage supposes a deposit level of well over 30%.

So, repayments might be much higher for many homebuyers than the median suggests.

The most recent ABS data suggests weekly salaries suggest, that on averages and medians, mortgages sit between a fifth and a third of monthly salaries.

And, if that was the case for most people, that would likely mean people would not be under mortgage stress. But that’s not the reality.

Rising house prices, even they aren’t accelerating at the same rates we saw two or three years ago, mean many people are borrowing at levels that are 80% or more of the median house price.

In Sydney, that may mean borrowing three or four times the median mortgage.

For a household on two full-time incomes, that may be achievable but it’s not always possible for a family to have all the parents working full-time.

I’m old enough to remember mortgage rates in the teens during the 1980s. And when I bought my first home in the 1990s, rates were around 10%.

When I took out my most recent mortgage, I budgeted on the assumption interest rates would increase to around that level again. Perhaps not this year or next but just in case something wild happens.

As to how much you should be paying now?

Even a few dollars over and above the minimum payment makes a difference in the long term. And fortnightly, rather than monthly payments make a difference.

If you simply halve the monthly payment and make that each fortnight, you’ll take a few years off your mortgage as you’ll be effectively making an extra monthly payment each year.

When you calculate your budget and what you’ll be able to pay on your mortgage, plan for other challenges.

What happens if the fridge dies? Or someone loses their job for a month or two?

Do you have any cash reserves after you’ve made your purchase?

Lots of people end up in financial distress over their mortgage and, while it’s not always avoidable, you can mitigate some of the risks.

In the old days, banks limited mortgages so that monthly payments did not exceed a quarter of your salary. It was a tough rule but it’s still a solid guideline to follow.

* Anthony Caruana is a writer, presenter, facilitator, journalist and consultant who can be contacted@Anthony_Caruana.

This article first appeared in www.lifehacker.com.au